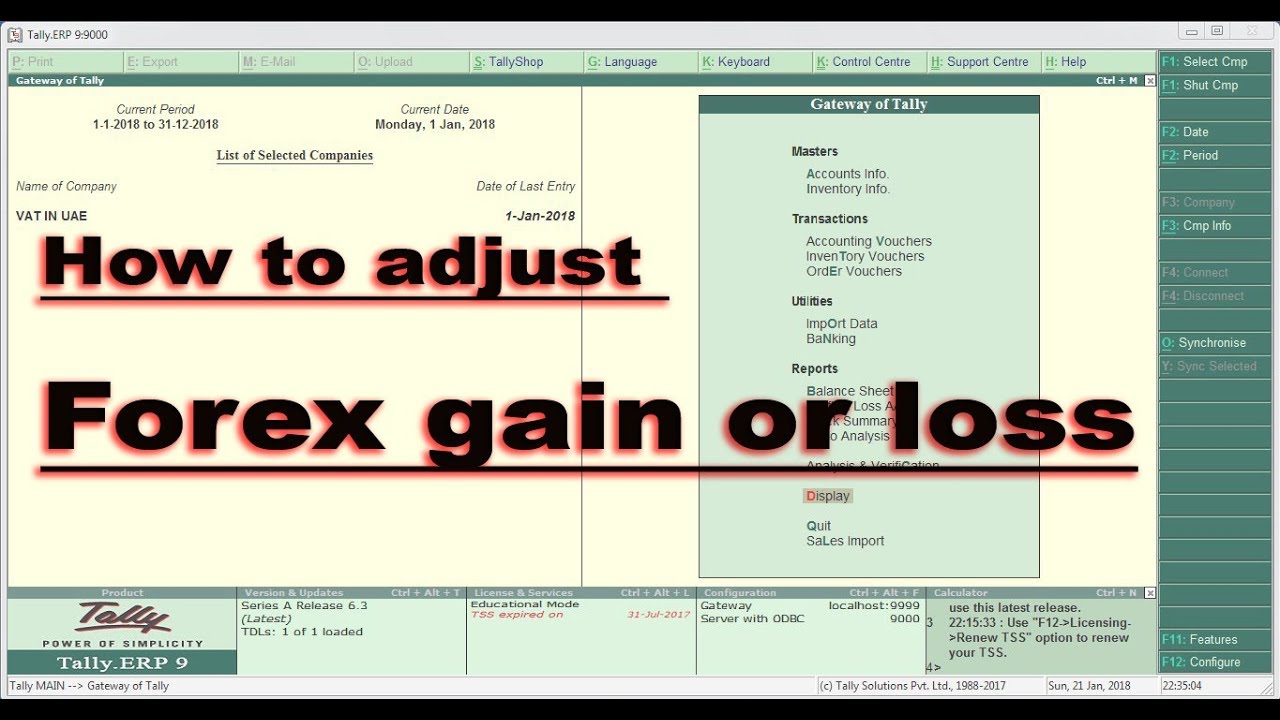

1/27/ · A foreign exchange gain or loss accounting example is when the EUR customer pays the invoice to the US seller. Let seller from the US posts an invoice for EUR to a German customer. Let on the invoice date, EUR is worth USD and on Estimated Reading Time: 4 mins Forex Profit and Loss Accounting. Profit and loss, good and bad luck, elation and depression lie very close beneath each other in online Forex trading. Who has made a profit of $1, yesterday may lose twice as much with today’s trades. And in practice it is so that the vast majority of the traders lose money with Forex trading 3/23/ · For example, foreign currency exchange (FOREX) gains/losses from collection of receivables and payment of liabilities are considered realized and are considered taxable gains/deductible losses since these are considered completed transactions, but FOREX gains/losses resulting from year-end conversion of foreign-currency denominated receivables and payables are considered unrealized

IAS 21 — The Effects of Changes in Foreign Exchange Rates

Forex vs Stocks: How Safe Are Shares Or The Forex? As an investment category, yes. All sorts of prudent and conservative institutions colleges, pension funds, foundations, trust departments invest in stocks. There is, technically, greater risk in common stocks than in the Forex. But as any experienced investor can tell you, there are many not-unusual situations in which a common forex or accounting can be viewed as a better safer investment than the issues ahead of it. Or, take forex or accounting common stocks of corporations like General Electric and Union Carbide.

Who would argue that the bonds of even a first-class railroad, for example, were necessarily safer? Safety also depends, to an extent, on the price at which the stock was bought.

A company may be solid as a rock, but eager investors may have bid its stock to an unrealistically high level in terms of the per-share earnings likely to be attained. If a quarterly or year-end earnings statement does not bear out the optimism of the eager buyers, they may begin to unload. The man who has bought near the top and wants to hang on may see a dismaying depreciation in his holdings, even though, by all investment standards, he does own a good, safe stock.

The point is, forex or accounting, some stocks are safer than others, and the value of all stocks may shift and vary and thereby alter temporarily their safety the forex or accounting of cashing them at the price paid for the investor. It is not hard to find a safe stock, if by that you mean one representing a lively, forex or accounting, alert, efficient company that is unlikely to collapse and fail.

While not every stock listed on the New York Stock Exchange is a daisy, forex or accounting, the mere fact that it has met the requirements for listing says much in its favor. For one thing, to obtain listing a company must agree to report its financial condition regularly. This is not to say that unlisted stocks or stocks carried on other exchanges is chancy. As you can quickly discover, some rather fine companies are not on the so-called Big Board the New York Stock Exchange.

The Great Atlantic and Pacific Tea Company, Humble Oil, and Creole Petroleum are listed on the American Stock Exchange. Such representative companies as Anheuser Busch, Eli Lilly, and Time, Inc.

are unlisted and traded only in the over-the-counter market. Few insurance companies and no banks both quite stable stock categories are listed on the New York Stock Exchange. Still and all, the new investor will be wise to confine his dealings to stocks that forex or accounting relatively well-known and have a ready market.

For out of the estimated 5, public, stock-issuing corporations in the United States there are, inescapably, some dogs. They do not have to be thieving and corrupt. Poor management, wobbly financing, and an inability to keep pace with the times in production and distribution are reason enough for the investor to avoid them. These glitter like a prize in a shooting gallery, but they promise something for nothing, and this is no premise for a smart investor to accept.

Many are out-and-out swindles. Others are legitimate enough, but rank as the wildest sort of speculation; double-0 on the roulette wheel, or a mare in the Kentucky Derby will come home a winner more frequently than these babies.

For the man who can only be called the ignorant investor, they have a certain attraction. What is wrong with all of this is that at no point does value enter into the calculation. Anyone who does not consider the worth of what he is buying is a gambler, not an investor. The sorry result is that a few bad gambles can sour an otherwise sane person on the true value of investment. Beyond this, safety is largely forex or accounting matter of sanity.

There are many ways of examining a stock and of judging the time to buy it or sell it. All of them are available to the average investor. Learn them and use them. You will never get stuck with a poor stock masquerading as a safe one. Hedging Against Inflation: One of the big arguments in favor of stocks bears on another aspect of safety.

This is the fact that stocks may frequently act as a hedge against inflation. Inflation, according to the forex or accounting definition, forex or accounting, is forex or accounting economic condition resulting in a rise in prices and a drop in the purchasing power of the dollar.

In effect, goods are scarcer than money. Thus, through the operation of the forces of supply and demand, goods become more expensive, forex or accounting. Dollars, relatively more plentiful, become cheaper more of them are needed to buy this item or that. In the United States, inflation has been at work for some time.

It is not runaway inflation. Our productivity goods is managing to stay fairly well abreast of our prosperity money. In a fluid situation like this, the safety of investment takes on a new dimension. Many conventional ways to save through a savings account, an annuity, forex or accounting, a Government bond held to maturity can practically guarantee the safety of the principal.

You will always get out the same number of dollars you put in. But there is no assurance as to how much those dollars will buy. Stocks cannot guarantee that the amount you have invested will be returned to you, safe and sound.

But when dollars are plentiful and goods bring a fat price, it is possible that a company in whose earnings you have a share will be distributing dividend dollars more liberally. So shares and the Forex have risks but if you are aware of them you can make sure you limit them. With the Forex, you can use good Forex software that is available to limit your losses. Save my name, email, and website in this browser for the next time I comment.

Home Accounting Applications Taxation Small Business News. Sign in. Log into your account. your username. your password, forex or accounting. Password recovery. your email. Forgot your password? Get help. Dollar Accounting. Home Forex Forex vs Stocks. RELATED ARTICLES MORE FROM AUTHOR. Facebook Fundraising. Why Crowdfund? Ultimate Guide to Nonprofit Fundraising. LEAVE A REPLY Cancel reply. Please enter your comment!

Please enter your name here, forex or accounting. You have entered an incorrect email address! Stay Connected. Privacy Policy for Dollar Accounting Contact us About us.

MORE STORIES.

Forex Accounts NRE NRO FCNR RFC RFCD

, time: 1:05:29Understanding Forex Accounting (with example)

1/27/ · A foreign exchange gain or loss accounting example is when the EUR customer pays the invoice to the US seller. Let seller from the US posts an invoice for EUR to a German customer. Let on the invoice date, EUR is worth USD and on Estimated Reading Time: 4 mins 9/17/ · Foreign exchange (Forex) accounting for beginners. Wise. 5 minute read. If you do any sort of business with overseas companies, you’ll likely end up sending or receiving payments in a currency that’s different from your home currency. Since exchange rates can fluctuate day-by-day or even hour-by-hour, it’s important to keep careful 6/2/ · The forex market is an over-the-counter (OTC) market and the counterparties in this market are mainly banks and financial institutions. The transactions are negotiated based on the interbank rates and the currency pairs traded include EUR/USD, GBP/USD and USD/JPY. For example, the functional currency for Bank A is the US$ dollar (USD).Estimated Reading Time: 2 mins

No comments:

Post a Comment