Trend indicators in this sense act as trend filters, though it’s possible to use them for generating trading signals. Usually, when a trend indicator is used for trading signals, a shorter lookback period is applied to make it more leading than lagging. As always, the “best” setting is hard to figure blogger.comted Reading Time: 7 mins For a trend to happen, the market moves in wave patterns. In an uptrend, the market will make Higher Highs and Higher Lows. In a downtrend, the market will make Lower Lows and Lowe Hights. To further define the trend, we want to add two filters Two Moving Averages; A Higher Time FrameEstimated Reading Time: 7 mins 9/6/ · When selecting the best indicator for your own algorithm, there are an additional three things you want to be on the lookout for. 1 – An indicator that avoids getting you into a trade too early and often. A lot of trend indicators do this. Too many bad signals that get your trade stopped blogger.comted Reading Time: 5 mins

Forex Indicators For Trend Analysis, Moving Averages - Forexearlywarning

Every forex trader who depends on technical analysis also depends on technical indicators for their trading process, why use a forex trend indicator. Every trader is different and some traders are better at using certain indicators over others, and some indicators are better suited to certain market conditions over others.

But there are some indicators that I have personally found to be demonstrably effective in developing an edge over the forex markets — which I will explore in this post. In this post I will break down what I believe are the three absolute best forex trading indicators to use in your swing trading and even day trading strategies why use a forex trend indicator and why I personally depend on them in my own trading.

And the best part? I use this indicator in every single strategy I develop so that Why use a forex trend indicator can optimize stop loss and target placement. The ATR indicator is a technical indicator that calculates the average range of price candles over a given period of time. It was designed by the famous market technician J.

Welles Wilder Jr. Its main purpose is to measure volatility in the markets. By learning to interpret the ATR reading you can learn how to objectively determine market volatility in a practical manner, why use a forex trend indicator. This allows you to adapt your strategies across multiple markets and market conditions with relative ease. There are only a few alternatives for stop loss placement without employing the ATR. Why use a forex trend indicator common one is to use a fixed pip amount, which is extremely difficult to adapt and optimize across multiple markets and trading conditions.

Because the ATR gives you a measure of price volatility in price units pipsyou can use it to calculate your stop loss and targets in an why use a forex trend indicator, adaptable why use a forex trend indicator objective way that can drastically improve your forex trading results! As a side note, if you want a more advanced way of applying the ATR indicator, you can try my premium ATR By Time indicator for free:. One of the biggest problems retail traders typically face when starting out in the forex markets is setting their stop loss orders far too tight.

Using the ATR indicator is a fantastic way to fix this problem by introducing an objective rule into your trading plan based on the ATR reading. In the example above the reason to go long would be the bullish engulfing candle right near support. The ATR value at the time was 0. By adding these together to get a In this example which is an example of my personal forex trading strategywe have used a trailing stop loss order to lock in profits on an open trade.

Every time the market breaks into a new low the black lineswe trail our stop loss 1 ATR above the swing high preceding the breakout the red lines. This way we allow the market to run in our favor as long as it can while locking in profits, yet giving the trade enough room to breathe during retracements, why use a forex trend indicator. Using this method is fantastic for capturing high-momentum and trending markets as you are guaranteed to stay in the trade until the trend reverses in which case we want to be out anyway.

The catch is you will sometimes give back a lot of open profits, so it is best to combine this approach with a price-action based exit strategy — for example, you may want to come up with a reason to exit when price is near There are pros and cons to all approaches to profit taking so it is up to you to backtest and find a method that you are comfortable with. In this example we are using the ATR value to set our take-profit order at a fixed price — 2x ATR below our entry price.

The biggest advantage to this approach is that there is zero discretion involved in exiting the trade. The other advantage is that you are basing your fixed target on the current market volatility.

If the market is trending and has momentum behind it then a 2 ATR move is not only possible, but probable. This type of fixed-target strategy is fantastic for beginner traders. It is easy to backtest and easy to execute. And by only ever taking profit you can get away with a lower win rate.

The main drawback is that you are capping your upside which is rarely a good idea in forex trading. Personally I like to use a combination of fixed targets and trailing stop targets. I open two positions per setup with the same stop loss, one with a target 1 ATR from my entry RR and the other position with a trailing stop such as in the previous example. This is a technique I learned from my trading mentor Steven Hart.

You should always do your own testing before you decide on which approach to take. Like I said in the previous example, there are pros and cons to all approaches to profit taking.

It is up to you to balance your methods with your psychology so that you can develop a trading plan that you can execute with confidence and consistency. Stop loss hunting is a common problem in trading. There are going to be certain occasions where using the ATR to set your stop loss will get you taken out right before the market rolls over in your initial direction.

not during low-liquidity sessions when large traders can bully price aroundand also being creative with how you employ the ATR. All forex trading strategies will inevitably experience losses, which is where good risk why use a forex trend indicator comes into play — but I can guarantee you that this problem will be much worse if you use less than a 1 ATR stop distance, particularly on intraday timeframes.

Just make sure to test your strategy over historical data first to make sure that whatever ATR stop you use enhances your edge instead of sabotaging it. I believe it is important that all traders have at least a basic understanding of how their indicators function and what their intended purpose was when they were conceptualized. In futures trading the market has a close and an open each day which can result in gaps in price. Therefore J, why use a forex trend indicator.

designed the ATR formula to account for that. Once this value is calculated for historical bars, the current ATR value is typically determined by a period moving average of these values.

So the ATR value you see on your indicator screen is an average of the past 14 ATR values. This means that as markets expand and contract this volatility reading will adapt to the change in candle price ranges. What Is Pine Script? The RSI indicator cops a lot of flak in the forex trading community from certain forex traders, why use a forex trend indicator, why use a forex trend indicator I find it to be quite a useful tool if you use it appropriately. It was created by the same guy who made the ATR indicator — J.

But first of all, what is the Why use a forex trend indicator indicator and why was it made? It is an oscillator indicator which means it can only emit values between a range of 0 and It was originally designed for stock trading to determine price momentum objectively in the quest to identify overbought and oversold conditions.

A high RSI value means that many of the recent candles have been bullish, whereas a low RSI value means that most of the recent candles have been bearish, why use a forex trend indicator. In forex it is used slightly differently. Unlike stocks and traditional markets, currencies can and will make moves that defy the laws of market physics — although stocks do that sometimes too.

But whenever there is a dramatic shift in global market fundamentals, why use a forex trend indicator, cycles or overall conditions, some currencies will enter oversold and overbought territory for lengths of time that will make your eyes water. The most effective way to use the RSI indicator in forex trading is to spot momentum divergences — particularly on intraday trading timeframes.

This may sound complex if you are new to forex trading but experienced traders know exactly what I am talking about. RSI divergence is a common trading filter for a reason — it works.

It is not a magical indicator that will never lose you trades. In fact, because it why use a forex trend indicator typically used to pick tops and bottoms which is a style of counter-trend tradingit can be quite difficult for new traders to master.

But once you have experience with strategy development and analyzing price action effectively, the RSI can be used to develop consistently profitable trading strategies with the correct application under the right market conditions.

Perhaps my favorite application of RSI divergence is on double-tops and double-bottoms that occur near major structure. In the above example we have a double-top which occurred near a major higher-timeframe resistance level followed by a bearish engulfing candle confirming price failure.

We also have divergence on the RSI. This means nothing to us yet. But then when we get a second top which fails at the exact same price as the first top, we do not get an equal or higher reading on the RSI indicator. In fact we get a much lower reading that tells us the momentum leading up to this second top was not nearly as strong as the first top, which is a hint that maybe the buyers are exhausted at this level. So using a simple price action pattern to confirm our thesis in this case, a bearish engulfing candlewe go short.

Using the ATR indicator we place a 1 ATR stop above the first top and place our target at the nearest major support level. Winning trade. Obviously this is a cherry-picked example, but if you go through your historical data and test this strategy with the right rules and conditions you will find an edge with it.

Why use a forex trend indicator this example price made an impulsive move down and went heavily oversold on the RSI, but then when price rolled over and made another lower-low, the RSI did not make a lower-low or equal low.

This can be a counter-trend setup that signals potential price exhaustion. I would recommend being extra careful with these setups personally I would only trade these setups near major levels of support.

But it can be a profitable approach to counter-trend trading if used properly and with discretion, why use a forex trend indicator. I would not recommend this strategy to new traders but experienced traders should definitely experiment with RSI divergence. The examples above are both occurrences of regular divergence where price makes an equal high or higher high but the RSI makes a lower low or vice versa for bullish divergence.

There is another lesser-known version of RSI divergence which can also be used to create profitable trading strategies, and that is called hidden divergence. Bullish hidden divergence is characterized by price making a low, then rallying, then during the retracement price makes a higher low but the RSI prints a lower why use a forex trend indicator. The opposite is true for bearish hidden divergence. Price makes a high, then falls lower, then during the retracement price makes a lower high but the RSI prints a higher high.

In the case of bullish hidden divergence, this is telling you that the trend is bullish price is making higher lows why use a forex trend indicator the longs have panicked and over-sold the crap out of it — creating a potential capitulation buying opportunity for aggressive trend-continuation buyers.

Bearish hidden divergence is telling you that the trend is bearish price is making lower highs but buyers have gotten a little exuberant and FOMO has caused a buying frenzy — creating a great shorting opportunity for aggressive trend-continuation sellers. The obvious trading sin is to use it as an overbought and oversold signal, why use a forex trend indicator.

The more subtle weakness with RSI divergence is that it is usually a counter-trend or at least a counter-momentum signal. You can find situations where RSI divergence occurs during trend-continuation but it is rare. More often than not this setup is trading against the underlying medium-term momentum which makes it tricky for some people to trade effectively. There will be times when RSI divergence will fail and price will enter consolidation or form a flag pattern before heading higher or lower in the case of bullish divergence setups.

As with all strategies, RSI divergence is not a foolproof trading method. The RSI formula is designed to give an objective indication of the magnitude of current price momentum. It is an oscillator indicator which means the value it generates is capped between 0 towith 0 representing extreme bearishness and representing extreme bullishness.

Best Forex Trend Detector

, time: 24:475 Best Trend Indicators That Tells You the Direction of the Trend

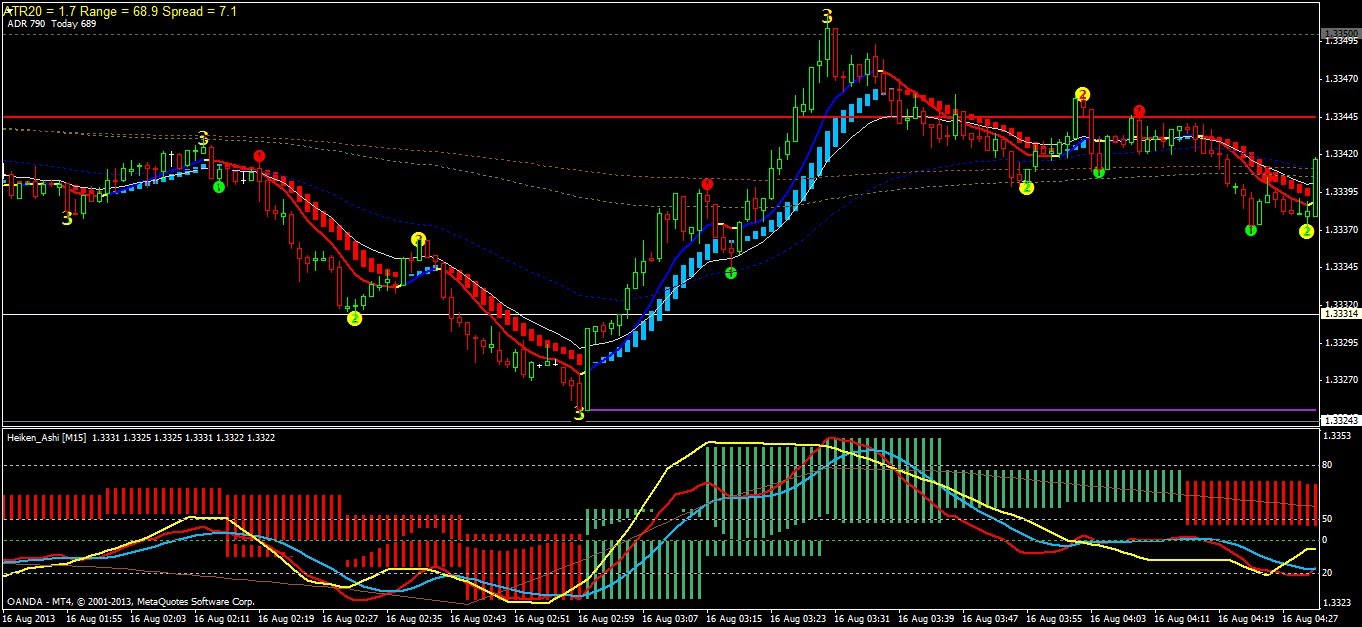

12/1/ · Elite CurrenSea uses the Awesome Oscillator (Elliott Wave) as a wave trend indicator – available for free via MetaTrader 4/5 (MT4). The AO (Awesome Oscillator), which is created by the Elliott Wave expert, legendary trader, and Fractal creator Bill Williams, is in our view the best oscillator for analyzing the waves of the Forex, CFD, and other financial blogger.coms: 4 For a trend to happen, the market moves in wave patterns. In an uptrend, the market will make Higher Highs and Higher Lows. In a downtrend, the market will make Lower Lows and Lowe Hights. To further define the trend, we want to add two filters Two Moving Averages; A Higher Time FrameEstimated Reading Time: 7 mins Forex Trend Indicators, New Trends. One powerful reason for using trend indicators is to locate the beginning of the trend and enter trades there, so as a trader you can ride the trend up or down and do less work while still making a lot of pips. This is especially true on the higher time frames. Let's look at the example below

No comments:

Post a Comment