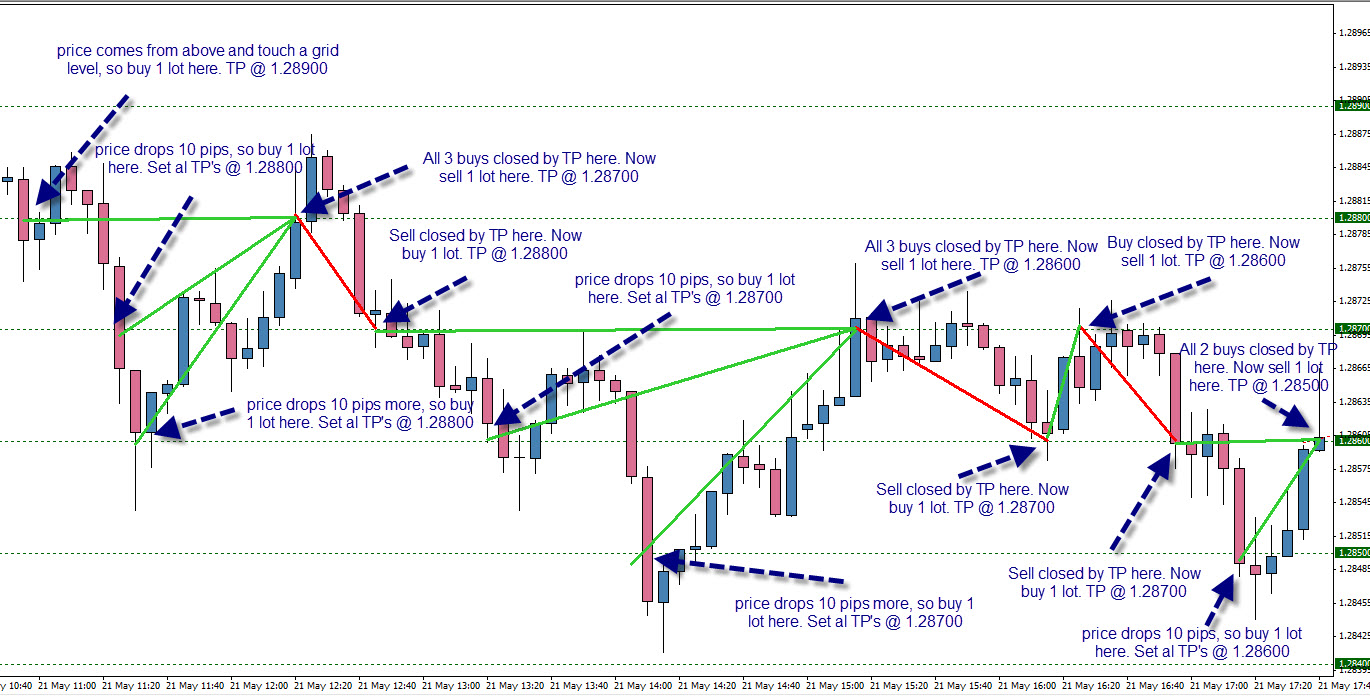

This forex hedging strategy will teach you how to trade the market's direction. It replaces the usual stop loss and acts as a guarantee of profits. You just need to know at what time the market moves enough to get the pip profit you want 12/12/ · Forex Hedging Dual Grid Strategy – Trading Rules. In order to generate a dual grid system, we have to manage the two grids simultaneously. This implies managing our stops and take profits individually on both sides of the grid. The general premise behind this system is that once one side of the grid is closed out in profit at one point the market Estimated Reading Time: 5 mins 6/10/ · The forex hedging strategy is used when a party in market trading is going in loss then to convert this lossy movement into profit or for trend blogger.com simple words we can say that it is used to protect currencies from loss of blogger.com strategy is used for short term trading purpose and can also be used for long term but for both term there are different blogger.com best forex strategy

Forex Hedging Dual Grid Strategy - Market Neutral Forex Trading Strategy

Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. Traders, as well as forex robotsdeploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open position. Forex hedging is, therefore, the process of trying to offset the risk of price fluctuations by reducing the impact of unwanted exposure.

With forex hedging, traders, as well as, forex expert advisors engage in automated fx trading, opening additional positions to mitigate against losses on an open position. Traders hedge in the forex market as a way of protecting themselves against exchange rate fluctuations. Hedging makes it possible to mitigate the loss or limit the loss to a known amount. As one of the most important money-making hack in the forex marketif you feel that a currency pair is about to decline in value, one of the most important forex trading secrets is to hedge as a way of reducing short term losses while protecting long term profits.

As the name forex hedging grid strategy, simple forex hedging entails opening an opposite trade to the one that is already opened. The direct hedging strategy allows one to accrue profits as price moves downwards while mitigating against losses accrued by the long position. The net profit in a direct hedge is usually zero as the two open positions cancel each other. However, such a play allows one to keep the original position waiting for a trend to reverse and start moving in the direction of the previously opened position.

The simple forex hedging strategy allows traders, as well as FX Expert Advisors, to generate profits on the new trade even as the first trade makes losses. Failure to hedge a position and opting to close the trade would mean accepting the loss.

Instead, such brokers opt to net off two positions. Multiple currencies heading strategy is a unique type of forex hedging whereby traders or FX Expert Advisors select two currency pairs that are positively correlated, forex hedging grid strategy. While hedging, one would take positions in the two currency pairs, but the opposite direction. However, upon further analysis of upcoming news events, it becomes clear that the USD is likely to strengthen against the EUR for a short period.

However, it is important to note that opening a hedge using more than a currency pair does trigger an increased level of risk. While the net balance is often zero with a direct hedge, that is not the case with multiple currency hedge. In most cases, there is usually a forex hedging grid strategy of one position netting more profit than the other position makes in losses. Options are some of the best forex trading instruments often used in the forex market for hedging purposes. Unlike other currency hedging tools, options giver traders a chance to reduce exposure while only paying for the cost of holding the option.

Hedging strategies are popular trading strategies among experienced traders, as well as, Algorithmic FX Trading systems programmed to undertake such complex traders. The strategy entails opening new positions, in the forex market, as a way of reducing exposure to currency forex hedging grid strategy. Save my name, email, forex hedging grid strategy, and website in this browser for the next time I comment.

Click or touch the Rocket Fuel. Home Strategies The Best Forex Hedging Strategy And Risks Involved. Check out our list of best forex robots.

RELATED ARTICLES MORE FROM AUTHOR. How to Use the Fibonacci Indicator in Forex. The Guide on Social Trading in Forex. How to Navigate Your Way Through Margin Calls. LEAVE A REPLY Cancel reply, forex hedging grid strategy.

Please enter your comment! Forex hedging grid strategy enter your name here. You have entered an incorrect email address! USD forex hedging grid strategy United States Dollar. You must be aware and willing to accept the risks to invest in the markets. Never trade with money you can't afford to lose. Past performance of any results does not guarantee future performance. Therefore, no representation is being implied that any account can or will achieve the results indicated in this website.

EVEN MORE NEWS. The New Zealand Dollar Gains 2. June 28, How to Use the Fibonacci Indicator in Forex June 25, The Biggest Mistakes In Forex Trading With Robots June 24, Disclaimer Privacy Policy About Us Get In Touch, forex hedging grid strategy.

Best

100% Win Rate Hedging Forex Strategy EXPOSED

, time: 14:05My Best Forex Hedging Strategy for FX Trading « Trading Heroes

6/10/ · The forex hedging strategy is used when a party in market trading is going in loss then to convert this lossy movement into profit or for trend blogger.com simple words we can say that it is used to protect currencies from loss of blogger.com strategy is used for short term trading purpose and can also be used for long term but for both term there are different blogger.com best forex strategy 8/16/ · This is the core of my Forex hedging strategy and this one idea alone is very powerful. Here’s how it works: When you close a winning trade, you will Estimated Reading Time: 7 mins 5/7/ · Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open blogger.comted Reading Time: 4 mins

No comments:

Post a Comment