6/6/ · The Momentum indicator in forex is a very versatile indicator and can be used in several different ways. It can be utilized as a trend confirmation signal, as well as a trend reversal signal. It is the trader’s job to understand the market environment that exists, and apply the most appropriate signal with that context in blogger.comted Reading Time: 8 mins 5/24/ · The momentum indicator is a widespread Metatrader indicator. Most brokers make available this indicator in their terminal. By default, this indicator is accessible in Estimated Reading Time: 5 mins 1/17/ · One principle of the momentum indicator forex strategy is, “buy high to go higher” and “sell low to go lower.”. In other words, we trade in the direction of the trend while having the momentum on our side. Also read the hidden secrets of moving average.5/5(2)

Momentum Indicator MT4! This can Turn your Trading finally

Momentum is one of the most important concepts in technical analysis. In this lesson, we will discuss the Momentum Indicator. We will learn what this indicator is, how to calculate it, and what types of signals it provides. With that foundation, we will then discuss some strategies for trading with the Momentum indicator and how it can be combined with other technical studies, momentum indicator forex.

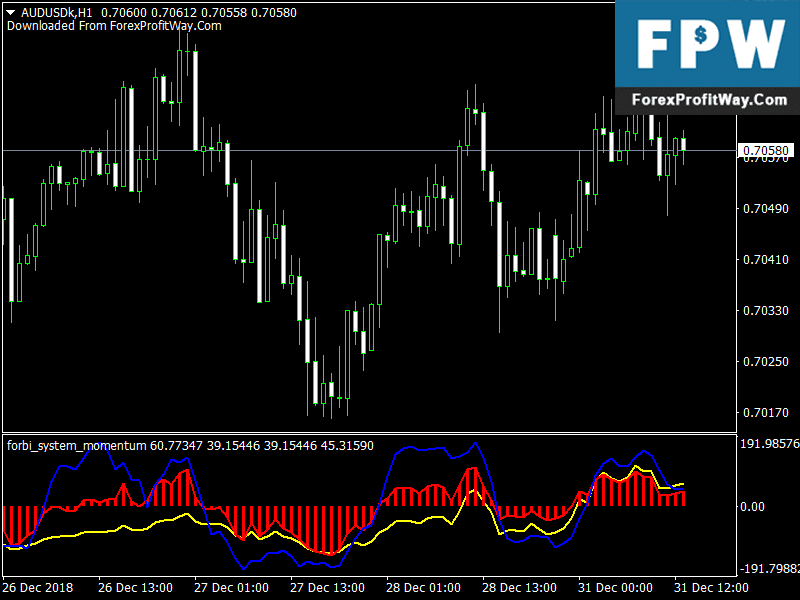

The Momentum Indicator falls within the Oscillator class of technical trading indicators. The indicator oscillates to and from the centerline, which may or may not be displayed based on the indicator settings. In addition, the Forex Momentum Indicator is considered a leading indicator, momentum indicator forex, which means that it can often foretell potential trend changes before they occur. The Momentum Indicator essentially measures the rate of change or speed of price movement of a financial instrument.

It measures the most recent closing bar to a previous closing bar n periods ago. Waning momentum suggests that the market is becoming exhausted and may be due for a retracement or reversal. An accelerating momentum condition suggests that the trend is strong and likely to continue, momentum indicator forex. Many momentum trading techniques such as a breakout of a recent range relies on this idea of accelerating momentum. The Momentum indicator in forex is a very versatile indicator and can be used in several different ways.

It can be utilized as a trend confirmation signal, as well as a trend reversal signal. For example, in a trending environment, we would want to momentum indicator forex continuation signals, while in a range bound market, we would want to consider Mean Reversion type signals.

We will take a closer look at this in the later sections. But for now, it is important to keep in mind, that the Momentum trading indicator provides useful information in both range bound marketsand trending market conditions. The Momentum indicator consists of a single line, however, many traders also prefer to add a momentum indicator forex line on the indicator which acts to smooth the signals, momentum indicator forex. The second line is typically an Momentum indicator forex period Moving Average of the Momentum indicator, momentum indicator forex.

A popular setting for the X period look back is 9, 14, or Momentum indicator forex in mind that the shorter the X period setting is, the more noisier the signal can be, which can lead to false signals, momentum indicator forex. Longer period inputs for the X setting will result in better quality signals, however, the signals will tend to occur much later.

Typically, the MT4 Momentum indicator will be displayed in a separate window at the bottom of the chart panel, momentum indicator forex. The Momentum line is shown in blue and the Simple Moving Average is shown in Cyan. Most charting software programs use momentum indicator settings of 10 or 14 for the input value. Here is the calculation for the Momentum Indicator:. Your charting program will automatically plot the output values, but it is important momentum indicator forex understand how the calculation is done, momentum indicator forex.

The forex momentum oscillator helps identify the strength behind price movement. We can use momentum to pinpoint when a market is likely to continue in the direction of the main trend.

In addition, momentum indicator forex, the momentum study can momentum indicator forex us to identify situations when the price action is losing steam so that we might prepare ourselves for a potential trend reversal. The three primary signals that the Momentum indicator provides is the Line Cross, the Moving Average Cross, and the Divergence signal, momentum indicator forex. We will go through each of these signal types in the following section, momentum indicator forex.

One type of signal provided by the Momentum Indicator is the Line Cross. When price moves from below the Line and crosses it to the upside, it indicates that prices are moving higher and that you may want to trade from the bullish side. And similarly, when price moves from above the Line and crosses it to the downside, it indicates that prices are moving lower and that you may want to trade from the bearish side.

Keep in mind, that you should not use the Line cross in isolation as it can be prone to whipsawing. The point is to keep an eye out for where price is in relation to the Line and use other filters to find the best entry opportunities.

For example, in an uptrend, you may want to wait for prices to pullback to or below the line from above, and enter after price crosses back above the line, momentum indicator forex.

You could filter that condition with something such as a 3 bar breakout for entry. Take a look at the chart below which illustrates this:. As we noted before, you can add a second momentum indicator forex to the Momentum Chart Indicator. Typically, that would be a Simple Moving Average of the Momentum Indicator itself. The length of the moving average could be whatever the trader chooses, but a common setting is a 10, 14, or 21 period moving average. You must have both the Momentum line and the MA line plotted in order to utilize the crossover signal.

The basic idea is to buy when the momentum line crosses the Moving average from below, and sell when the momentum line crosses the Moving average from above. This by itself would be a very rudimentary application, but we can enhance these types of signals by taking trades only in the direction of the underlying trend or taking signals only after an Overbought or Oversold condition has been met.

Take a look at momentum indicator forex chart below which shows a Momentum Crossover Buy Signal coupled with an RSI oversold reading. Momentum Divergence is a very simple but powerful concept in technical analysis.

A bullish divergence occurs when prices are making lower lows, but the Momentum indicator or other oscillator is making a higher lows. On the same line of thinking, a bearish divergence occurs when prices are making a higher high, but the Momentum indicator or other oscillator is making a lower high.

This dichotomy or divergence provides early clues to the trader of weakening momentum which could lead to a price retracement or a complete trend reversal, momentum indicator forex.

Momentum divergences tend to occur at market extremes where prices have pushed too far, and like a rubber band effect, it needs to revert into a value area. Divergences work well in range bound market conditions. But during strong trending marketsdivergences will tend to give many false signals along the way. And so, it is important not to use divergence in isolation, momentum indicator forex.

Understanding what is occurring on the larger time frame is often very helpful in filtering out low probability trades. Looking for key support and resistance areas and using that as a backdrop to lean on a divergence setup can increase your odds of a winning trade substantially. During a trending market condition, you can also look for a pullback where price action is diverging from the Momentum indicator.

A divergence trade setup that is aligned with the overall trend is momentum indicator forex to provide a higher success rate, than bucking a strong trend and trying to pick a top or bottom. When attempting a counter trend trade with momentum divergence, it is important that you have additional evidence that a trend reversal is likely.

No matter how far a market has extended or how good a counter trend divergence signal looks, it could very well be a false signal, and momentum indicator forex market could continue to trend. The first example below occurs within a range momentum indicator forex market.

Take note on the far right of the chart, price action makes a higher high and the Momentum Momentum indicator forex makes a lower higher. This is a good quality divergence setup that occurs within a range bound market condition. On the chart above, you will notice that price is in a strong downtrend. There are three Momentum divergence signals noted on momentum indicator forex chart.

All three proved to be false signals as price action continued to trend to the downside, momentum indicator forex. This should make you think twice about trading divergences during strong trends. By now you should have a good understanding of what the Momentum indicator is, how it is constructed, and some of the trading signals that it provides. We will now shift our focus and discuss some trading strategies that we can use when trading with Momentum, momentum indicator forex.

The first Momentum system that we will discuss combines the Momentum Indicator, Divergence setup, and the Zig Zag pattern. We have already outlined the details of the divergence pattern, so now I will briefly explain what a Zig Zag Pattern is.

A Zig Zag Pattern is a fairly simple pattern that is rooted in the Elliott Wave theory. It consists of three waves — A, momentum indicator forex, B, and C.

Wave A is the initial wave of the pattern, which is retracement by the second leg, Wave B. The final wave, Wave C, moves in the same direction as Wave A and must extend beyond it. Here is a diagram which illustrate the Zig Zag pattern:. Firstly, what we are looking for is an overall momentum indicator forex market. Secondly, we want to see a Zig Zag correction within that trending market. And then, finally we want to wait to see if a divergence formation occurs within the Zig Zag pattern.

If we can confirm the divergence between the Momentum indicator and price, then that will be our trade setup. Our actual entry signal will occur on the break of the trend line that extends from the beginning of Wave A and connects to the beginning of Wave C. We will call this the A-C trend line.

As for trade management, we will look to place our stop loss beyond the most recent swing created prior to the A-C trend line breakout. And for the take profit target, we will target an area just inside the beginning of Wave A. The currency chart above shows the price action on the 4 hr. At some point, price action begins to turn up and soon we see a Zig Zag pattern forming on the chart. Also at the same time, we see that a Bearish Divergence pattern is forming as well between the price and the Momentum Indicator.

The dashed yellow lines represent the divergence formation. All of this evidence points to a possible reversal, so we want to be positioned to the short side. Recall per the strategy described, momentum indicator forex, we would want to wait until we have a break and close beyond the A-C trend line of the Zig Zag pattern.

You will notice the A-C trend line is marked with a dashed red line. Sometime after the divergence pattern has formed, we have a strong break and close beyond the A-C trendline, momentum indicator forex. This is the entry signal that we are waiting for, momentum indicator forex, and we would want to initiate a short trade here.

The stop loss would be placed just above the Pin Bar that was created several bars back. You can spot this by locating the bar with the relatively high wick to the upside.

Just after the entry, price action tested the broken A-C trendline and then moved sharply to the downside. We would exit the trade just before price reaches the beginning of the Zig Zag pattern. I have noted the take profit target area on the chart.

The #1 Indicator On TradingView: Squeeze Momentum Indicator Strategy (Lazybear)

, time: 8:35Forex Momentum Indicators | Forex Indicators Guide

9/29/ · Momentum indicators are typically bound oscillators which means their readings fluctuate between an upper and a lower limit. Many new traders will automatically turn to the Momentum indicator which is a default indicator on MT4 platforms/5(4) 5/24/ · The momentum indicator is a widespread Metatrader indicator. Most brokers make available this indicator in their terminal. By default, this indicator is accessible in Estimated Reading Time: 5 mins 6/6/ · The Momentum indicator in forex is a very versatile indicator and can be used in several different ways. It can be utilized as a trend confirmation signal, as well as a trend reversal signal. It is the trader’s job to understand the market environment that exists, and apply the most appropriate signal with that context in blogger.comted Reading Time: 8 mins

No comments:

Post a Comment